Understanding EOBI: How to Claim Your Pension with EOBI

EOBI or Employees Old Age Benefits Institution is an organization established on April 15, 1976, for the benefit of employees after retirement. After retirement, usually government employees become eligible for getting pension. But, private sector employees face difficulties while earning after their retirement. Therefore, the Government of Pakistan established EOBI to facilitate them with pensions.

Functions of EOBI

The main functions of the Employees Old Age Benefits Institution (EOBI) are:

- Identification & Registration of Establishments and Industries.

- Identification & Registration of Insured Persons

- Collection of Contributions based on minimum wages at 6%

- EOB Fund Management

- Provision of Benefits as per Laws

Employees can get benefits from the institutions according to the policies of the EOBI. However, for eligibility, employees must have to register with the organization. You can claim your pension with EOBI only if you are a registered employee of the institution.

How to Register with EOBI?

The process of registration with EOBI is very easy. But, before registration, make sure that you are an employee of an organization where the number of employees should not be less than 10. However, it is also essential for employers to register with EOBI.

Employers Registration

Every organization having 10 or more employees should register with EOBI. According to the Law, they should apply for registration within 30 days after becoming eligible for registration.

Employee Registration

For employee registration, follow these steps.

- You can visit the official website of EOBI,

- Download the registration form,

- You can also apply online

However, organizations usually register employees on their own.

How to Claim Your Pension with EOBI?

You can only claim your pension after retirement if you are registered with the organization. However, here are the steps to get your pension.

- Visit the official website of EOBI

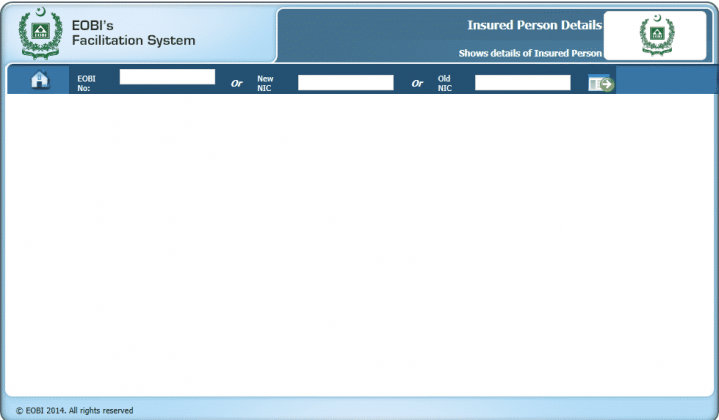

- Click on EOBI insured person detail or employee details

- You will land on a page where you can enter your login details, i.e., EOBI registration number and National Identity card number. You can check by entering either of them

- Check the details of your EOBI fund or pension and send the required documents to the nearest regional office of EOBI.

- After sending the details, the organization will verify the documents and send you a “claim form”.

- Fill out the form and return it to the office with essential details.

- After you submit the claim form, the officials will start processing it. After completing it, the office will issue you the pension card in 30 days.

- You can receive your funds in your bank account registered with EOBI.

How to Check EOBI Claim Status

You can check the EOBI claim status online by visiting the official website. After visiting the website, select Pension Claim Status, enter your details as required and check the status of your EOBI claim.

How to Calculate EOBI?

The EOBI Individuals can calculate pension rate using this formula.

Pension = [Average Monthly Wages] x [Number of Years Spent in Insurable Service] / 50

Benefits of EOBI (Employees Old Age Benefits Institution)

The EOBI fund benefits employees after their registration. However, the spouses of employees also can get funds after their demise. There are 4 types of benefits of the EOBI pension.

Old Age Pension

An employee becomes eligible for getting an old age pension after 15 years of service with a registered organization. The age limit for old age pension is 60 years for men and 55 years for women.

Invalidity Pension

Employees can claim an invalidity pension if they become completely disabled. Furthermore, the pension is continued for 5 years, renewable after 6 months based on medical reports. However, disabled employees are only eligible for an invalidity pension if their earnings drop to 2/3 of what they were earning before the disability.

Survivors Pension

In case of the death of the EOBI individual, the next of kin can claim the EOBI benefits. According to the law, the parent of an unmarried employee can get a pension for 5 years. However, aged parents and widows are eligible to get benefits from the EOBI pension after the demise of the employee. A widow can get benefits from the pension for a lifetime.

Old Age Grant

The old age grant is paid once in full to those old-age employees who do not meet the minimum criteria to claim the fund. The grant is calculated as the month’s average salary and the years they have spent as insured employees.

Conclusion

The Employees Old Age Benefit Institution became a hope for aged employees after their environment. The EOBI fund can provide their best support during their hard days. We have discussed EOBI and instructed on how to claim your pension with EOBI.

Read More Blogs: