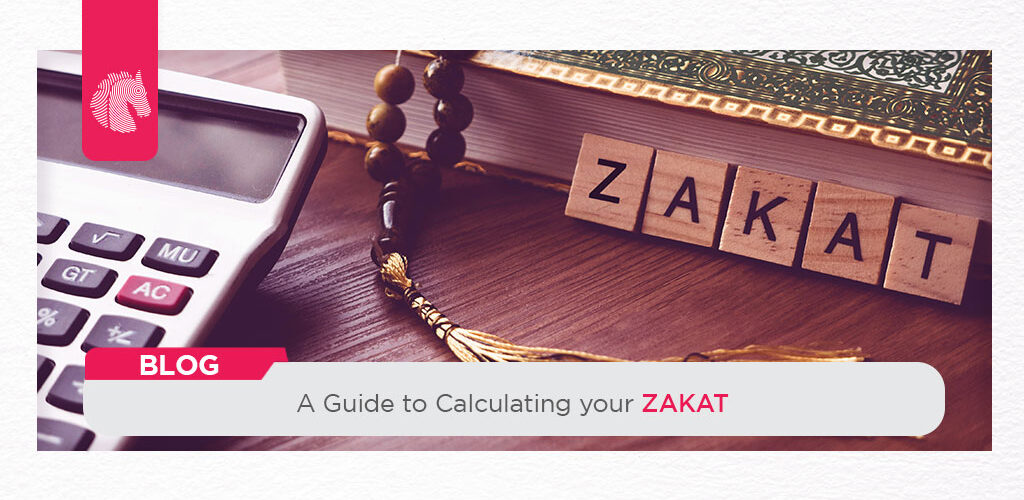

A Guide to Calculating your ZAKAT in 2024

Zakat is the fourth pillar of Islam. Muslims must pay it after possessing a fixed amount of wealth also called Nisab for 1 lunar year. After the compulsion of Zakat, the amount is given to poor and needy people. However, this amount increases and decreases according to the fixed ratio of 2.5%. So, here is a complete guide to calculate your Zakat in the year 2024.

Muslims can pay zakat in either month of the year, but Ramadan is the best month for donating to charities and paying Zakat. Therefore, it is recommended to calculate your zakat and pay in the month of Ramadan. Zakat is paid according to the Nisab fixed according to the Quran and Hadith.

Zakat Nisab 2024

Muslims who possess 87.48 grams (7.5 tola) of gold or 612.36 grams (52.5 tola) of silver are obliged to pay Zakat. However, in the modern day, gold and silver are not used as currency. Therefore, Zakat becomes compulsory in your local currency equivalent to the amount of gold and silver. Furthermore, Zakat does not apply to your personal use assets i.e. your clothes, car, house, and other appliances. Now, if you want to know whether you are obliged to pay Zakat, or how much Zakat you have to pay, find it in easy steps by using a Zakat calculator.

Zakat Calculator 2024

First, you have to find out whether you are sahib-e-nisab. The formula for calculating your Nisab is:

The rate of gold in Pakistan is multiplied by 7.5 (7.5 tola or 87.46 gram is gold Nisab for Zakat).

Currently, the rate of gold per tola in Pakistan is PKR 225,100. So, the Zakat gold Nisab is PKR 1,688,250. It means that if you have that amount of savings or assets equal to that amount for a full lunar year, you are eligible to pay Zakat.

In addition, the silver Nisab for Zakat is 52.5 tola silver. Nowadays, the price of per tola silver is PKR 2629. So the Silver Nisab for Zakat is PKR 138,022. It is always recommended to use Silver Nisab for paying Zakat as it is more rewarding.

However, it is important to remember that the value of your assets must remain above the Nisab amount for the whole year. If the value of your assets decreases before ending of the year, you will not be eligible to pay. But, if it reaches the Nisab again, from that day, the year for Zakat will be restarted. Now, you are Sahib-e-Nisab and want to calculate your Zakat. Here you can do it easily. There are certain ways of finding the amount of Zakat.

How to Calculate your Zakat on Cash

Calculating Zakat on cash is very easy. For example, you have 2 million cash for the whole lunar year. The ratio of Zakat is 2.5%. So, the payable zakat amount will be PKR 50,000.

While calculating your Zakat, add your assets and exclude the liabilities. The rules of Zakat will apply to the remaining amount. Here are some assets that are to be included and liabilities that are to be excluded.

Assets to be Included

- Cash at home or in the bank

- Foreign currency

- The value of all the gold and silver that you own in your local currency

- The market price value of any shares that you own

- The dividend received from shares

- Money that is payable to you

- Rental property owners should tabulate any saved rental income as well

Liabilities

- The total amount of pending utility as well as credit card bills

- Any pending amount of rent you owe to your landlord

- The outstanding amount of loans

- The value of a property that you’ve given on rent to your tenant

- Any payable amount as salaries

You can determine it by using a simple formula which is [total assets – liabilities = net amount for calculating zakat].

Conclusion

We have discussed in detail about Zakat Calculator 2024. You should know that the Nisab for Zakat is variable depending on the current prices of gold and silver. So, the Zakat calculator will you to easily find your Zakat according to the fixed ratio. Furthermore, we also practiced calculating zakat manually and brought important aspects to the limelight.

FAQs

How do you calculate Zakat step by step?

Use the Zakat calculator to calculate your Zakat step by step.

How to calculate the Zakat formula in Pakistan?

Total assets – liabilities = net worth for Zakat. Now to calculate the amount of Zakat, multiply the netw worth for Zakat by 2.5 and divide by 100.

What are the formulas for Zakat?

The formula for Zakat is [net worth for Zakat x 2.5/100].

What is Zakat on 1 tola gold?

The Zakat is applicable on 7.5 tola gold or 52.5 tola silver.

Read More Blogs