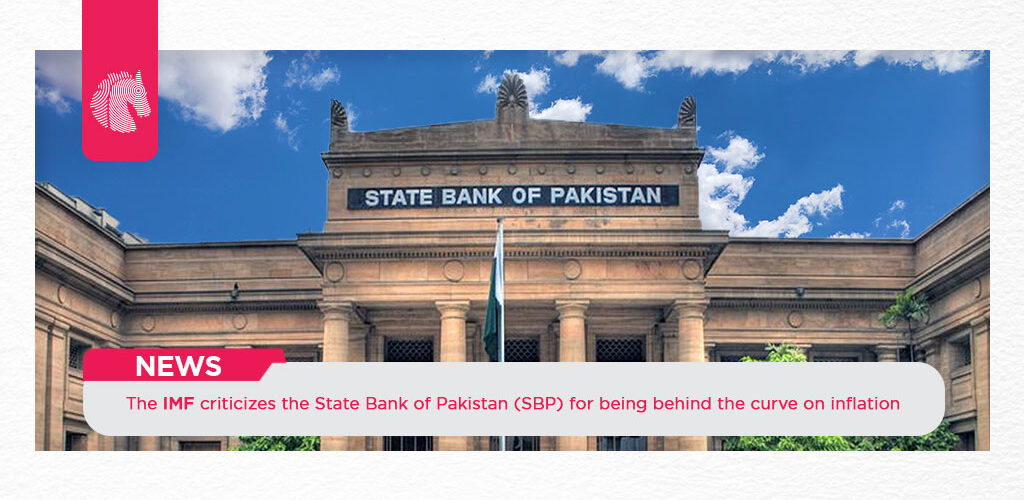

The IMF criticizes the State Bank of Pakistan (SBP) for being behind the curve on inflation

The International Monetary Fund (IMF) has strongly criticized the State Bank of Pakistan (SBP) for its delayed response in addressing inflationary pressures since 2020, stating that the monetary policy fell behind the curve. The IMF staff report, following the approval of a $3 billion Standby Arrangement Programme for Pakistan, highlighted that the SBP’s loose monetary policy conditions and several pauses in the policy rate tightening cycle contributed to unanchored inflation expectations, resulting in a five-decade high inflation rate.

To combat the persistent inflation, the IMF urged the SBP to maintain a tight, proactive, and data-driven monetary policy. The recent policy rate hike was welcomed, but further tightening may be necessary to reduce inflation and achieve the SBP’s inflation objectives over the medium term. The IMF emphasized the need for stronger SBP independence and the phased-out implementation of refinancing schemes to enhance monetary policy traction and transparency.

While some authorities remained optimistic about inflationary pressures receding, the IMF projected elevated inflation rates, particularly due to the delayed monetary tightening measures. The report indicated that inflation is expected to remain above 25 percent in FY24, with gradual deceleration in subsequent years.

In the past six months, rising food prices, exchange rate depreciation, and supply shortages contributed to soaring inflation, impacting vulnerable populations significantly. The SBP’s actions were perceived as lacking clarity, with rate hikes occurring intermittently.

Experts acknowledged the stubborn nature of inflation in Pakistan, attributing it to various factors such as depreciation, supply shocks from natural disasters like floods, fiscal slippages, and delayed monetary tightening responses. To address inflation effectively, they suggested maintaining a real positive interest rate and tackling fiscal and governance issues, along with focusing on expenditure management, productivity, and economic efficiency.

It is clear that controlling inflation requires a comprehensive and innovative approach, involving both monetary and fiscal measures to stabilize the economy and protect the well-being of the people.